Unshackling Our Freedom to Trade

Free trade will make us all wealthier and give us greater access to goods and services.

The consensus among economists is that by expanding the size of the market to enable more refined specialization and economies of scale, free trade creates more wealth than any system that restricts cross-border exchange. Nearly all agree that the intellectual case for specialization and free trade articulated by Adam Smith in The Wealth of Nations in 1776 and the law of comparative advantage expounded by David Ricardo in On the Principles of Political Economy and Taxation in 1817 have endured the test of time to remain beacons of economic thought.

Possibly even more compelling than the economic argument for free trade is the moral case, which finds its roots in John Locke’s articulation of natural rights. The moral case posits that people are free to pursue their own industry and are entitled to the fruits of their labor, which include the right to exchange their output with whomever they choose and on whatever terms they agree to. To exchange is a natural right and, when executed voluntarily on agreed terms, is inherently fair.

In contrast, when government intervenes to change terms and influence outcomes on behalf of one party or one set of interests at the expense of others, it subverts the rule of law and encourages the diversion of productive resources from economic to political ends. Instead of investing in new factories, service centers, machines, workers, and research and development across the country, businesses are incented to invest in Washington because they perceive politics to pay bigger dividends.

Free markets are essential to our prosperity. Free trade is the extension of free markets across political borders. Making markets freer and expanding them to integrate more buyers, sellers, investors, and workers both deepens and broadens that prosperity. True free traders abhor domestic trade barriers and want them removed regardless of whether other governments remove their own barriers, because the benefits of trade are the imports we obtain, not the exports we give up. The benefits are measured by the value of imports that can be purchased for a given unit of exports—the more, the better. Trade barriers reduce those benefits, which include greater variety, lower prices, more competition, better quality, and the innovation spawned by those and other factors.

To oppose free trade is to favor not only suboptimal economic outcomes but also intrusive, immoral actions by governments. Unfortunately, although the case for free trade is a moral and economic one, trade policy is a creature of the political realm. For centuries, politics—where demagoguery, subterfuge, and coercion are the currency—has obscured the case for free trade.

That said, we have made progress. Increasingly, the politics have been constrained. By historical standards and relative to present norms in most other countries, the U.S. government’s trade restrictions are a modest intrusion. Many of the most obvious restrictions on our freedom to trade have been significantly curtailed. From its peak in 1932, the average U.S. tariff fell from about 60 percent to about 4 percent in 2017, and most quotas have been abolished. 1 At the end of 2017, Americans were freer to engage in international trade than at any time in U.S. history.

But before we prematurely declare “mission accomplished,” we still have a long way to go. Amid our abundance, most of us fail to notice the extent to which government continues to abridge our freedom to trade. It is in that oversight that we fail to imagine life in a world truly free of trade restrictions.

Why Do We Trade?

To grasp the significance of a future free from government restrictions on our liberty to trade, it is important to understand and appreciate why we trade in the first place. Imagine life without trade. Imagine a life of solitude. To attend to your own subsistence, you wake each morning before sunrise to make your clothes, build and repair your meager shelter, hunt and harvest your food, concoct rudimentary salves for what ails you, and toil in other difficult and tedious tasks. Forget luxuries. Forget leisure. All of your time would be consumed trying to produce basic necessities merely to subsist. Life would be nasty, brutish, and short.

Fortunately, most members of modern societies choose not to live that way. In fact, one of the defining features of modern society is that most of its members recognize—actively or tacitly—the benefits of institutions, such as cooperation. Most of us don’t attempt to make everything we wish to consume. Instead, we specialize in a few, or a couple, or just one value-added endeavor—one profession. What makes specialization possible is our commitment to the concept of exchange, which is the ultimate expression of cooperation.

The purpose of exchange is to enable each of us to focus our productive efforts on what we do best. Rather than allocate small portions of our time to the impossible task of producing everything we need and want, we specialize in what we do best, produce more of it than we need, and exchange that surplus for other things we need or want but haven’t produced.

The law of comparative advantage explains why this arrangement enables us to produce, and thus consume, more output than would be the case in the absence of specialization and trade. If Aaron can produce $100 worth of venison in eight hours but only $50 worth of clothing in eight hours, he has a comparative advantage producing venison. By specializing in venison production, Aaron forgoes $1 worth of clothing to obtain $2 worth of meat. But to forgo production of clothing, Aaron needs some assurances that he can obtain clothing by exchanging surplus venison.

Because Paul, who lives nearby, is more efficient at producing clothing than venison—he can make $40 of clothing but only $30 of venison in an eight-hour day—he specializes in clothing production and forgoes producing venison at all, knowing he can obtain it through exchange with Aaron. Paul has a comparative advantage producing clothing.

How do we know Aaron and Paul are better off by specializing and exchanging? By specializing, their combined output is $140 per day ($100 of venison and $40 of clothing). Had they chosen to live in solitude and not exchange, they could still produce $140 per day, but Aaron would have only venison and Paul would have only clothing. Any attempt by either man to produce a combination of these products would yield less total output. If each devoted four hours each to venison and clothing production, for example, their combined daily output would be $110. Aaron would produce $50 of venison and $25 of clothing; Paul would produce $15 of venison and $20 of clothing.

Moving from a two-person economy illustration, in the modern economy, we specialize in an occupation and exchange the monetized form of the output we produce most efficiently for the goods and services we produce less efficiently. It’s the same concept on a grand scale.

Enlarging markets entails the reduction or elimination of barriers that inhibit the free flow of goods, services, capital, and labor. The larger the market, the greater is the scope for specialization, exchange, and economic growth. Just as consumers have a greater variety and a better quality of items to purchase with their monetized output, producers have access to a greater variety and a better quality of inputs for producing most efficiently.

During the past few decades, a truly global division of labor emerged, presenting opportunities for specialization, collaboration, and exchange on scales once unimaginable. The confluence of falling trade and investment barriers, revolutions in communications and transportation, the opening of China to the West, the collapse of communism, and the disintegration of Cold War political barriers has spawned a highly integrated global economy comprising most of the world’s nearly 8 billion people with vast potential to produce greater wealth and higher living standards than ever before.

The factory floor is no longer contained within four walls and one roof. Instead, it spans the globe through a continuum of production and supply chains, allowing businesses to optimize investment and output decisions by matching production, assembly, and other functions to the locations best suited for those activities. Because of foreign direct investment in the United States and the United States’ direct investment abroad, quite often “we” are “they” and “they” are “we.” And because of the proliferation of disaggregated, transnational value chains, “we” and “they” often collaborate on the same endeavor.

In the 21st century, competition is more likely to occur between entities that defy national identification because they are truly international in their operations, creating products and services from value-added activities in multiple countries. In this regard, expanded world trade, which has resulted from elimination or reduction of both natural and artificial barriers, has reinforced good governance—or at least better governance. Because investment in design, production, assembly, distribution, and other supply chain activities flows to countries where government policies are less intrusive, less burdensome, and more predictable, governments have tended toward more liberal import and export regimes.

Usually without even thinking about it, Americans enjoy the fruits of international trade daily. Nearly every thread of clothing we own is made abroad. We take to the roads in vehicles assembled from parts manufactured in myriad countries. We book hotel rooms, order takeout, and purchase music and gifts for family and friends using smartphones assembled abroad from components made in third countries and running on technology developed in the United States.

We have more to spend, save, and invest because retailers pass on some of their cost savings in the form of lower prices, which are made possible by retailers’ access to thousands of foreign producers, who design and sell products that would never have been commercially viable without the cost efficiencies afforded by transnational production and supply chains. Because of trade, we enjoy imported fresh produce that was once unavailable out of season. Many of us deposit paychecks that are larger than they would otherwise be on account of our companies’ growing sales to customers abroad, or we enjoy salaries and benefits provided by employers that happen to be foreign-owned companies.

A recent study from the Peterson Institute for International Economics estimated that the payoff to the United States from trade expansion—attributed to policy liberalization and improved transportation and communications technology—between 1950 and 2016 was about $2.1 trillion and that U.S. gross domestic product (GDP) per capita increased by $7,014 (both measured in 2016 dollars). 2

Many of us take these benefits for granted—or at least we fail to attribute them to lower trade barriers. Although we tend to take notice of the “destruction” from trade, we are too often impervious to trade’s “creation.” We observe the clothing factory that shutters because it couldn’t compete with lower-priced imports. The lost factory jobs, the nearby businesses that fail, and the blighted landscape are all obvious. What is less discernible is the increased spending power of the divorced mother who must feed and clothe her children. Now, she not only can buy cheaper clothing, but also has more resources to save or spend on food, health care, and computers, which improves her family’s standard of living and underpins growth elsewhere in the economy. The adjustment costs of trade are immediate and observable, whereas the benefits of trade are obscured because they are dispersed and accrue over time.

Consider Apple, which relies on low-wage labor in China to assemble its devices. Apple may be depriving some U.S. workers of the opportunity to perform those low-end functions in the supply chain, but the production cost savings enables Apple to price iPods, iPhones, and iPads within the budgets of a large swath of consumers. If the government had compelled Apple to produce and assemble all components in the United States (something that both Presidents Obama and Trump have espoused), the necessarily higher prices would have prevented those devices from becoming ubiquitous, retarding or suppressing entirely the emergence of spinoff industries, such as those producing accessories and apps, which have created enormous value and employment opportunities throughout the U.S. and global economies.

Essentially, trade-barrier reductions begat transnational production and supply chains, which enabled the commoditization of powerful smartphone technologies, which created mass markets for new products and services, as well as new ways for billions of people around the world to communicate, shop, learn, and organize. Uber, Airbnb, Venmo, and so many other resource-saving innovations and conveniences might never have come to fruition had government restrictions on our freedom to trade been what they once were.

Indeed, we have made significant progress in restoring our natural right to trade, and the benefits of that progress are undeniable, if not obvious. But we still have a long way to go. Today, large swaths of the U.S. economy remain off limits to foreign competition. In other words, the government continues to restrict our freedom on a fairly significant scale.

How Does Government Restrict Our Freedom to Trade?

More than 150 years ago, the French classical liberal economist Frédéric Bastiat observed:

Between Paris and Brussels obstacles of many kinds exist. First of all, there is distance, which entails loss of time, and we must either submit to this ourselves, or pay another to submit to it. Then come rivers, marshes, accidents, bad roads, which are so many difficulties to be surmounted. We succeed in building bridges, in forming roads, and making them smoother by pavements, iron rails, etc. But all this is costly, and the commodity must be made to bear the cost. Then there are robbers who infest the roads, and a body of police must be kept up, etc.

Now, among these obstacles there is one which we have ourselves set up, and at no little cost, too, between Brussels and Paris. There are men who lie in ambuscade along the frontier, armed to the teeth, and whose business it is to throw difficulties in the way of transporting merchandise from the one country to the other. They are called Customhouse officers, and they act in precisely the same way as ruts and bad roads. 3

In Bastiat’s time, rapid technological progress in transportation led to a dramatic decline in freight costs, sparking the first great wave of globalization. Connecting cities by road and rail was intended to reduce the cost of travel and commerce. Just as reducing tariffs creates larger markets and greater scope for specialization, so does connecting those markets with physical infrastructure. Bastiat’s equating natural, geographic trade barriers (distance, marshes, rivers, ruts, and bad roads) to administrative or manmade trade barriers (customhouse officers guarding the frontier) was spot on. And it is just as apt today.

In 2017, U.S. Customs and Border Protection collected $33.1 billion in import duties—the “revenue” generated by assessing tariffs (which are taxes) on imported goods. Although the U.S. president and other politicians often invoke the need for trade reciprocity or calls for leveling the proverbial “playing field” as justification for imposing tariffs on goods imported from abroad, the fact is those tariffs are actually taxes imposed on American businesses and consumers. It is U.S. importers who pay the tariffs or duties or taxes to the U.S. government. Those taxes raise the cost of production for U.S. companies that rely on imported inputs and the cost of living for U.S. households, whose real income is reduced by the resulting higher prices on retail store shelves.

In 2017, about half of the value of U.S. imports consisted of raw materials, intermediate inputs, and capital equipment—the purchases of U.S. producers to manufacture their own output. Higher costs squeeze manufacturing profits, reducing the incentive and the ability to expand production, create more value, and employ more labor. This reality particularly handicaps smaller businesses seeking to challenge entrenched incumbents because the latter are more capable of absorbing the higher transaction costs. Just as tariffs on intermediate goods hurt small firms more than large firms, tariffs on final goods hurt lower-income households more acutely than they hurt middle- and upper-income households.

Spread across the $2.3 trillion value of all U.S. imports in 2017, the average applied tariff rate came to 1.4 percent. 4 Nearly 70 percent of all goods imports came in duty free; therefore, the average tariff rate on the 30 percent of products subject to tariffs was 4.1 percent. 5 Of course, that average conceals certain important points. Lower-income households spend a higher proportion of their resources on goods and the majority of goods consumed in the United States are imported. Among the most heavily “tariffed” products are clothing, footwear, foodstuffs, and building materials, such as lumber, cement, steel, paint, flooring, furniture, appliances, and nails. U.S. trade policy subjects life’s basic necessities—food, clothing, and shelter—to some of the most regressive taxes in the United States. And things may get worse before they get better. In 2018, President Trump started a trade war. As a result, Americans are less free to trade today than we were in 2017. Although it’s difficult to measure this “loss” of freedom, the president has imposed punitive tariffs ranging from 10 percent to 25 percent on about $320 billion of imports, which could result in U.S. Customs and Border Protection’s collections more than doubling to $70 billion. Is this bad, coercive, interventionist policy? Yes. Is it a huge burden? On some industries and households, yes, and any good libertarian or free trader would oppose Trump’s tariffs, as well as the tariffs that were already in place before Trump’s presidency.

As in Bastiat’s time, today we continue to observe that geography and distance present impediments to trade that we seek to overcome with ingenuity and determination, while we seemingly tolerate the manufactured trade barriers that mitigate or negate the benefits of that ingenuity and determination. But unlike Bastiat’s time, the most insidious trade barriers in the 21st century are those that exist not at the frontier but behind the border, in the form of domestic laws and regulations.

Throughout the U.S. services economy, the government continues to limit our choices to domestic sources. In industry after industry, foreign suppliers are precluded from fully competing for our dollars, which is another way of saying that we are denied the liberty to exchange on our own terms. We have “Buy American” rules, which restrict the pool of companies and products eligible for government procurement spending to domestic firms and U.S.-made products. And that mitigates the disciplining effects of competition on price and ensures that more taxpayer dollars get squandered. 6 We have laws forbidding foreign air carriers from competing on U.S. domestic routes, which raises the cost of business travel and leisure and reduces the quality of service. 7 We have laws restricting waterborne transportation of cargo to ships that are U.S.-built, -owned, -flagged, and -staffed, which raises the cost of transportation and, ultimately, the retail prices of nearly everything bought and sold in America. 8 We have public health, safety, and national security regulations that are often invoked as fig leaves to conceal protectionist motives. 9 We have a vast network of preclusions and restrictions on foreign professional, health care, and education services, to list some. 10 And beyond medicine and education, occupational licensing requirements, generally, present major obstacles to our freedom to trade with both domestic and foreign suppliers across many different services industries. 11

Ironically, protectionism is baked into our so-called free-trade agreements. It takes the form of rules-of-origin requirements, local content mandates, intellectual property and investor protections, enforceable labor and environmental standards, and special carve-outs that shield entire products and industries from international competition.

Tackling government’s restrictions on trade in services has proved considerably more difficult than reducing tariffs on goods. Among the reasons for this disparity is that services trade barriers are less obvious and less quantifiable. But considering that services constitute a much more significant share of the U.S. economy than goods, the benefits from services trade liberalization should be much more substantial than the benefits realized from goods trade liberalization.

Where Free Trade Is Needed Most

The significant reduction of trade barriers during the second half of the 20th century encouraged a surge in cross-border investment and transnational supply chains that lowered production costs and retail prices and made the United States and the rest of the world richer. But that liberalization affected mostly trade in goods. As such, our great “success” opening up the U.S. economy to trade should be viewed more as incremental progress than as “mission accomplished.” So far, trade liberalization has really restored only a small portion of our freedom to trade because the United States is a services economy, and protectionism remains in place throughout our most important services sectors. But that may soon change.

More than 70 percent of full-time-equivalent (FTE) U.S. workers are employed in the services sectors, including retail, transportation, health care, education, professional services, financial services, information, and hospitality. 12 In 2017, services accounted for more than $12 trillion (62 percent) of GDP and more than $9 trillion (70 percent) of household consumption expenditures. 13 For every dollar consumers spent on goods, they spent $2.20 on services. But only a tiny portion of that $2.20 was spent on services that were imported.

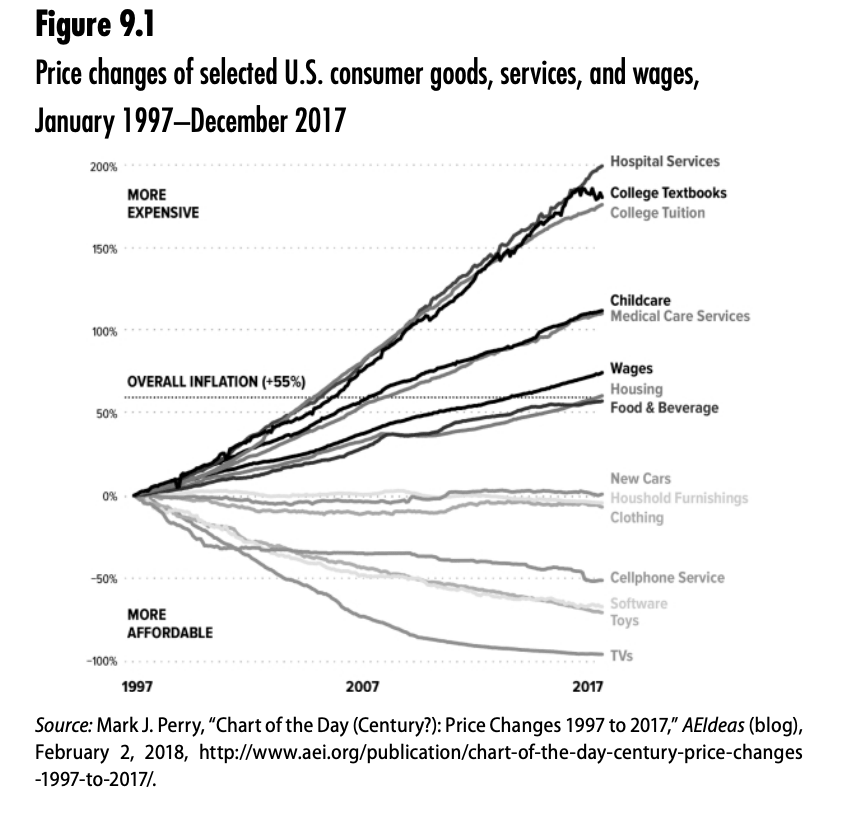

In 2017, consumers spent $9.2 trillion on services, only $550 billion of which were imported. 14 That amounts to about 6 percent or $0.13 of that $2.20. By contrast, U.S. consumers spent $4.1 trillion on goods in 2017, with imports of goods totaling $2.3 trillion that year. 15 Imports accounted for 57 percent or $0.57 of every dollar spent on goods. That wide disparity in import penetration—6 percent for services versus 57 percent for goods—suggests that the United States maintains fairly significant barriers to trade in services. Figure 9.1 appears to corroborate that theory.

One of the obvious takeaways from the figure is that, over the course of two decades, the prices of some goods and services decreased, whereas others increased—nothing too extraordinary there. On closer examination, however, it becomes clear that the

price declines occurred predominantly for goods, which are commonly imported and thus subject to foreign competition. But when domestic suppliers are not disciplined by foreign competition in the market, which is very much the case throughout the services industries, they need not care as much about pricing competitively. Their customers are relatively captive, demand is more price inelastic, and so prices rise.

Health care and education services—which together account for more than one-quarter of U.S. GDP—have experienced some of the largest price increases over the past two decades. At $10,348 per year, U.S. per capita spending on health care exceeds that of any other country by far, yet the quality of service as measured by morbidity, mortality, life expectancy, and other health metrics is middle of the pack. 16

Meanwhile, U.S. spending per full-time-equivalent student on elementary and secondary education is almost $12,400 (29 percent higher than the Organization for Economic Cooperation and Development [OECD] average of $9,600) and spending at the postsecondary level per FTE student was $29,700 (or 81 percent higher than the OECD average of $16,400). 17 Yet again, the quality of education services as measured by international test scores is middle of the pack.

Among the reasons for the high costs and middling quality in these two major industries are the limits imposed on competition through licensing and accreditation requirements, which restrict both domestic and foreign competition. These industries are not only ripe for reform, the benefits of competition are also sorely needed. Health care accounts for more than 18 percent of the U.S. economy and education (including postsecondary) accounts for more than 7 percent, yet only a tiny fraction of these markets is open to foreign health care and education service providers. Americans can import foreign services through four channels:

- By traveling abroad and consuming those services (as tourists, patients, or students, for example);

- By consuming services in the United States from an affiliate or subsidiary of a foreign-owned company (a restaurant, hotel, construction firm, or bank, for example);

- By receiving services from a foreign person who is performing those services in the United States (a consultant or accountant, for example);

- By cross-border supply of a service from the territory of a foreign country into the United States, typically delivered via telecommunications or postal infrastructure.

In the first three channels, both the provision and consumption of the service take place in the same country. In the fourth, the provider and consumer of the service are in different countries.

“Medical tourism”—which entails traveling abroad to receive medical care in the form of surgical or other procedures—is generally not subject to U.S. laws and regulations. Given the high cost of health care in the United States, it is not surprising that a growing number of Americans are partaking of this channel. The savings are so great—and the quality high enough—that some U.S. insurance companies are encouraging the practice and covering the travel and treatment costs. Some medical tourists go abroad for treatments that are not available or approved in the United States. According to Patients Beyond Borders, an estimated 1.4 million Americans went abroad for medical procedures in 2016. 18

But even if more health insurance plans cover medical procedures performed abroad, the logistical impracticalities of sick people traveling to foreign countries for medical care attenuate growth prospects in this part of the industry.

Likewise, Americans consume foreign education services primarily through the same channel—by going abroad. According to the Association of International Educators, 332,727 U.S. students enrolled in foreign universities in 2016–2017, which represents about 1.6 percent of all U.S. students enrolled at institutions of higher education in the United States. 19 But in most cases, this mode of consumption is not chosen as a lower-cost alternative. Rather, it is a unique experience for which students and their parents pay premiums.

Meaningful competition in health care and education services of the magnitude that can discipline prices and free up vast amounts of resources will require growth in the delivery of services through the second, the third, and, especially, the fourth channel. The fourth—where the provider is abroad and the consumer is in the United States—probably has the greatest promise, because the cost of delivering services over the internet is lower and decreases with technological advances.

A major obstacle to liberalization of these service sectors is the domestic providers, who are protected by licensing requirements, accreditation systems, and a web of state and national laws. But the government has no legitimate reason to impede U.S. consumers from procuring medical and education services from foreign providers. Given the skyrocketing costs and looming crises in these industries, it is imperative that the reforms necessary to open these markets be implemented as soon as possible.

How Will Free Trade Shape the Future?

Competition improves quality, innovation, and opportunities for more rapid adoption of life-enhancing and life-saving technologies. Yet, for the vast majority of things Americans consume, the supply options are limited to domestic sources only. Imagine that. With all we have learned about the benefits of trade, and as enlightened as we like to think we are, the United States—which is home to 1 out of every 20 people on Earth—has not yet opened up its services markets to competition from 95 percent of the world’s potential providers. Instead, we accept rules that require water and air transportation services in the United States to be provided only by U.S. companies using U.S. crews. Financial services, legal services, and other professional services, on which Americans spend hundreds of billions of dollars every year, are all largely restricted to U.S. companies. That is just astonishing.

The potential for the internet to deliver affordable, high-quality telemedicine and online education programs to broaden the supply of medical treatment and education services is great and realistic. As Simon Lester wrote in a 2015 Cato policy analysis on health care and trade:

Reform is coming to the field of medical services. Telemedicine can never completely replace in-person care, of course, but it will be a common and widely used method in the near future. Governments are beginning to recognize this, and domestic regulatory systems will have to be changed to accommodate it. 20

Imagine having a life-saving operation at your local hospital or medical office performed by automated medical instruments controlled by the world’s renowned expert in Singapore.

In an earlier Cato policy analysis on online education, Lester concluded:

The growth of online higher education is going to be extremely disruptive to the existing industry structure. There will be many complaints from those with a vested interest in the current system. But just as the music, book, and movie industries have had to do, traditional higher education institutions need to adapt to the online world. 21

Consider how much easier and more affordable it will be for your daughter to acquire the skills necessary to perform state-of-the-art surgeries, when she can learn from and interact with experts around the world through online classes and seminars.

Health care and education services—which account for one-quarter of U.S. GDP but rank among the least efficient sectors in the economy—will soon be open to significant foreign competition. As discriminatory regulations protecting domestic incumbent providers are removed to enable foreign competition, and the costs of delivering high-quality health and education services over the internet continue to fall, we should expect to see significant productivity gains and dramatically declining prices in these sectors. That is essentially what happened with manufacturing during the second half of the past century. Artificial barriers to goods trade (tariffs, quotas, import licenses) were eliminated or significantly reduced, which enabled global producers to disaggregate production and supply chain operations and to achieve greater economies of scale, all of which had the effect of driving down costs and thus prices. Meanwhile, advances in transportation—including quite significantly the advent of the shipping container and more efficient container ships—produced revolutions in transportation and logistics, which also contributed meaningfully to the decline in the prices of delivered goods.

The services sectors, by and large, have yet to experience a productivity revolution. Given the much greater importance of services to the U.S. economy, even modest productivity gains could generate significantly greater value added in the economy than could be accomplished from a much larger increase in productivity in manufacturing.

In other words, with increased focus on liberalizing services trade by reducing discriminatory regulations and tapping into new technologies and the powerful reach of the internet to deliver those services, the potential for favorably changing the trajectory of economic growth—while reducing the burdens imposed on the public by massive entitlements (of which health care costs are a major element)—is within reach. As usual, the key ingredient to realizing these fruits is first to realize the freedom to trade.

1. Douglas A. Irwin, Clashing over Commerce: A History of US Trade Policy (Chicago: University of Chicago Press, 2017).

2. Gary Clyde Hufbauer and Zhiyao (Lucy) Lu, “The Payoff to America from Globalization: A Fresh Look with a Focus on Costs to Workers,” Peterson Institute for International Economics Policy Brief 16–17, May 2017.

3. Frédéric Bastiat, Economic Sophisms, trans. Patrick James Stirling (New York: G. P. Putnam’s Sons, 1922), pp. 69–70, as quoted in Leland B. Yeager, Free Trade: America’s Opportunity (New York: Robert Schalkenbach Foundation, 1954), p. 13.

4. U.S. International Trade Commission (USITC) DataWeb (website).

5. USITC DataWeb (website).

6. For more details on “Buy American” restrictions, see Daniel Ikenson, “The False Promise of ‘Buy American,’” Cato at Liberty (blog) January 20, 2017.

7. For more details on commercial airline restrictions, see Kenneth J. Button, “Opening the Skies: Put Free Trade in Airline Services on the Transatlantic Trade Agenda,” Cato Institute Policy Analysis no. 757, September 15, 2014.

8. For more details on maritime shipping restrictions, see Colin Grabow, Inu Manak, and Daniel Ikenson, “The Jones Act: A Burden America Can No Longer Bear,” Cato Institute Policy Analysis no. 845, June 28, 2018.

9. For more details on protectionism masquerading as a national security imperative, see Daniel Ikenson, “The Danger of Invoking National Security to Rationalize Protectionism,” China-US Focus, May 15, 2017.

10. For more details on restrictions on trade in health care and education services, see Simon Lester, “Expanding Trade in Medical Care through Telemedicine,” Cato Institute Policy Analysis no. 769, March 24, 2015; and Simon Lester, “Liberalizing Cross-Border Trade in Higher Education: The Coming Revolution of Online Universities,” Cato Institute Policy Analysis no. 720, February 5, 2013.

11. For more details on occupational licensing, see Angela C. Erickson, “The Tangled Mess of Occupational Licensing,” Cato Policy Report, September–October 2018. ↩

12. Bureau of Economic Analysis, National Income and Product Accounts, Employment by Industry, Table 6.5D: Full-Time Equivalent Employees by Industry.

13. Bureau of Economic Analysis, Gross Domestic Product by Industry, Table 5: Value Added by Industry Group.

14. Bureau of Economic Analysis.

15. Bureau of Economic Analysis.

16. Bradley Sawyer and Cynthia Cox, “How Does Health Spending in the U.S. Compare to Other Countries?” Peterson-Kaiser Health System Tracker, February 13, 2018.

17. “Education Expenditures by Country,” National Center for Education Statistics (website).

18. Beth Braverman, “1.4 Million Americans Will Go Abroad for Medical Care This Year. Should You?” Fiscal Times, August 17, 2016.

19. “Trends in U.S. Study Abroad,” NAFSA (website).

20. Lester, “Expanding Trade in Medical Care.”

21. Lester, “Liberalizing Cross-Border Trade in Higher Education.”