The Human Meaning of Economic Growth

Misunderstandings of the relationship between wealth and flourishing have obscured the anti-human implications of slowing growth rates.

Why is the world as prosperous a place as it is? And why isn’t it much more prosperous? These questions are broad enough to admit countless possible answers, but as good an answer as any is the economic growth rate.

You might have heard that economic growth is overrated, that it’s a fine idea, but unsustainable, or even that it’s entirely counterproductive because it puts profits above people and the economy above the planet. These narratives have been widespread in recent years. They’re also based on a fundamental misconception of the nature of wealth and what a growing economy means for humanity.

Properly conceived, wealth is the actualization of human values in the real world. Economic growth is the upward trajectory of human achievement. The forms of prosperity that most of humanity strives for, such as health, knowledge, pleasure, safety, professional and personal freedom, and so many others, were vastly scarcer throughout most of human history—and would be orders of magnitude more abundant today if economic policies had been slightly different. That is the power of economic growth, and it is within our power to influence the world of future generations for better or worse.

The History of Economic Growth

Virtually everywhere and always throughout human history, economic growth was nonexistent. While pockets of momentary economic progress took place in certain instances, the overall trend was one of perpetual stagnation. But just a few hundred years ago, with the advent of the Enlightenment, the Industrial Revolution, and capitalism, that all began to change.

When the conceptual tools of science became widely applied to create the technological advancements of the Industrial Revolution, they brought an unprecedented optimism about the capacity for investment in new discoveries and inventions to reliably uncover useful knowledge of the natural world. This change inspired the broad transformation of mere wealth (resources hidden away in vaults and treasure chests) into capital (resources invested in new inventions and discoveries).

By the time Friedrich Engels and Karl Marx wrote their Communist Manifesto in 1848, the optimism of investment had already transformed Western Europe. As Engels and Marx saw it, “The bourgeoisie [capitalist class], during its rule of scarce one hundred years, has created more massive and more colossal productive forces than have all preceding generations together. Subjection of Nature’s forces to man, machinery, application of chemistry to industry and agriculture, steam-navigation, railways, electric telegraphs, clearing of whole continents for cultivation, canalisation of rivers, whole populations conjured out of the ground — what earlier century had even a presentiment that such productive forces slumbered in the lap of social labour?”

Marx and Engels misunderstand the complex reasons for increased productivity (attributing it to untapped “social labour”) but the quotation is significant because, despite their sympathy for state centralization of the economy, they could not ignore the success of capitalism.

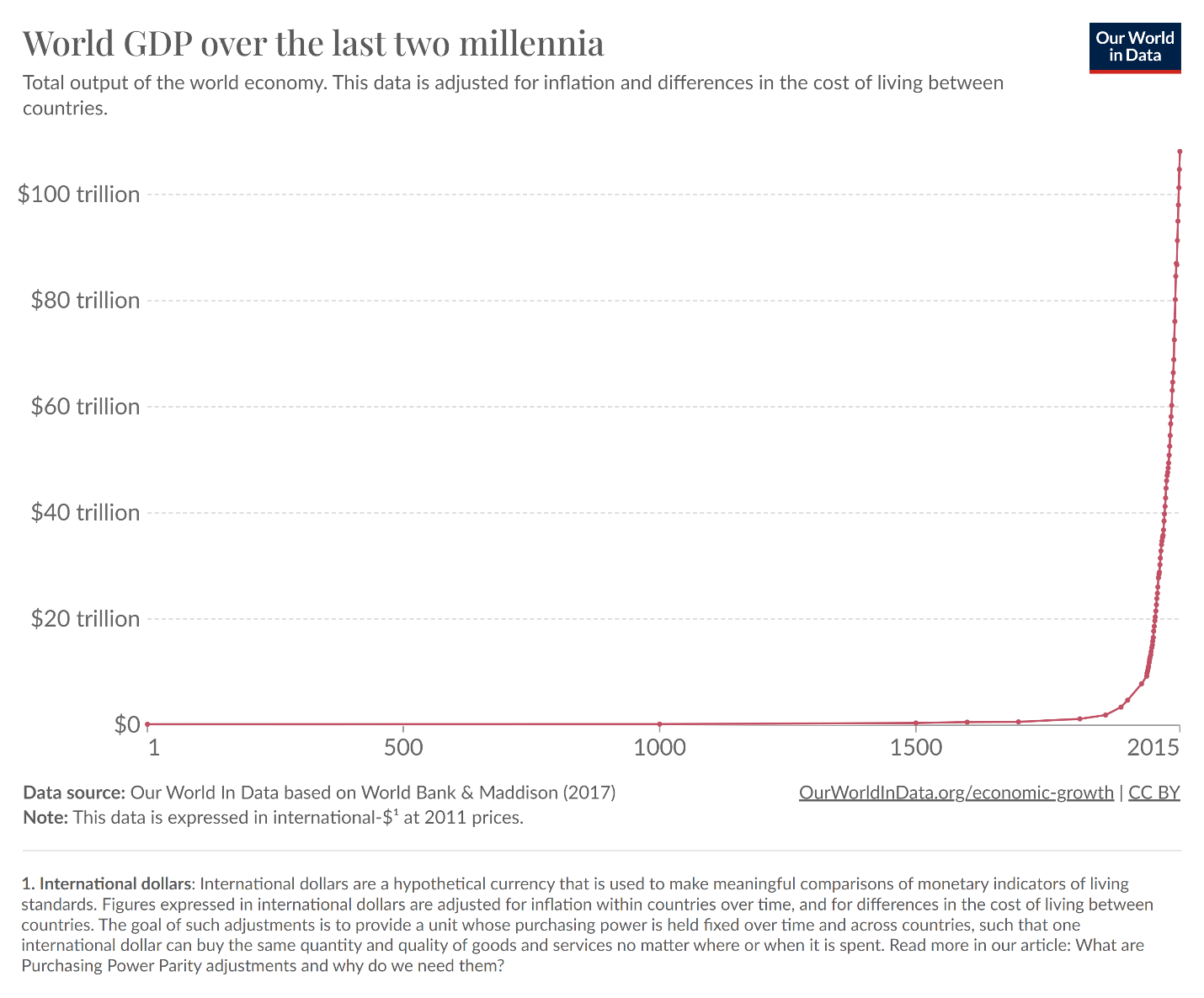

While no year before 1700 saw a gross world product of more than $643 billion (in international inflation-adjusted 2011 dollars), by 1820 GWP reached 1 trillion. By 1940 the number had passed 7 trillion, and by 2015 it had passed 108 trillion.

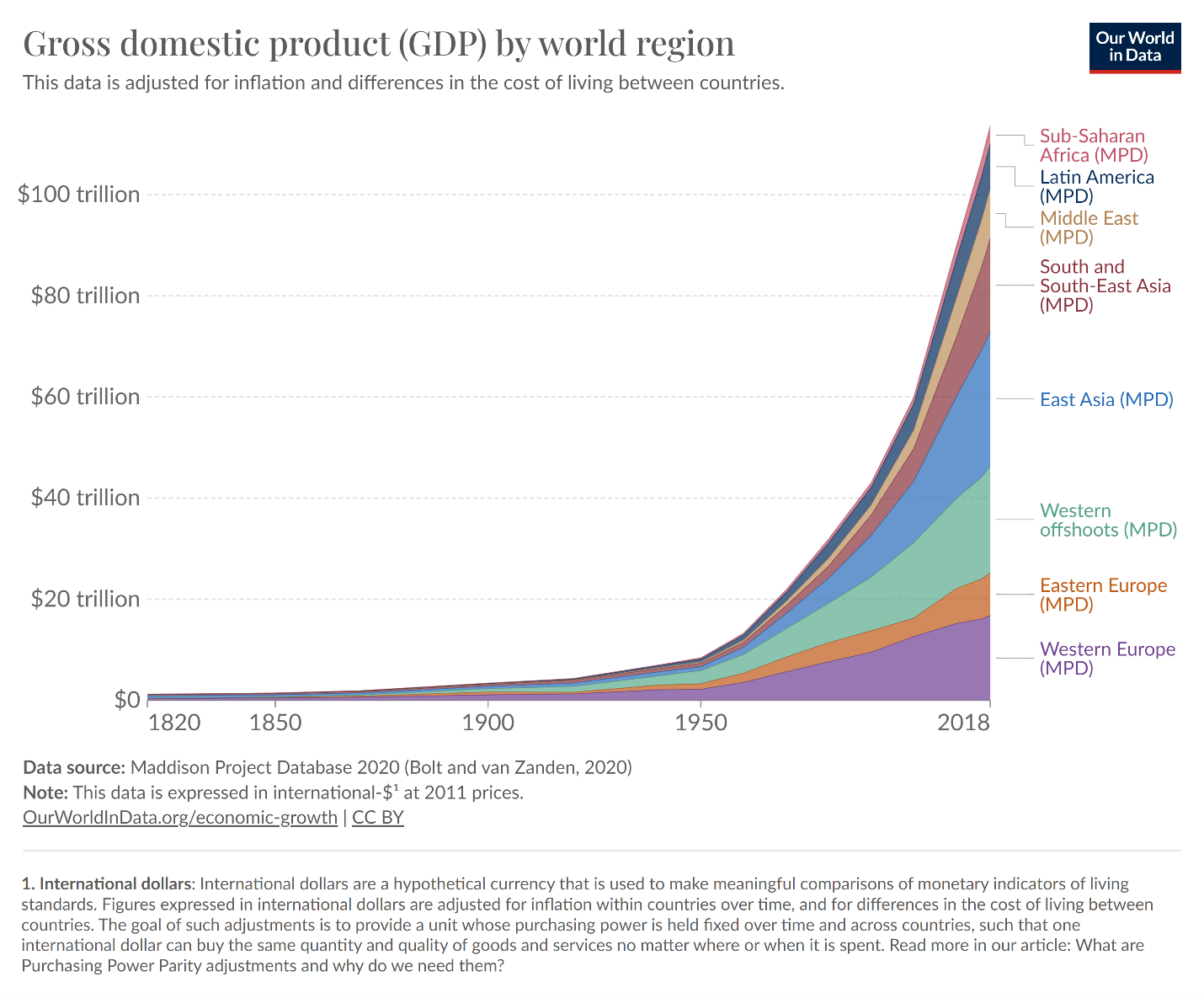

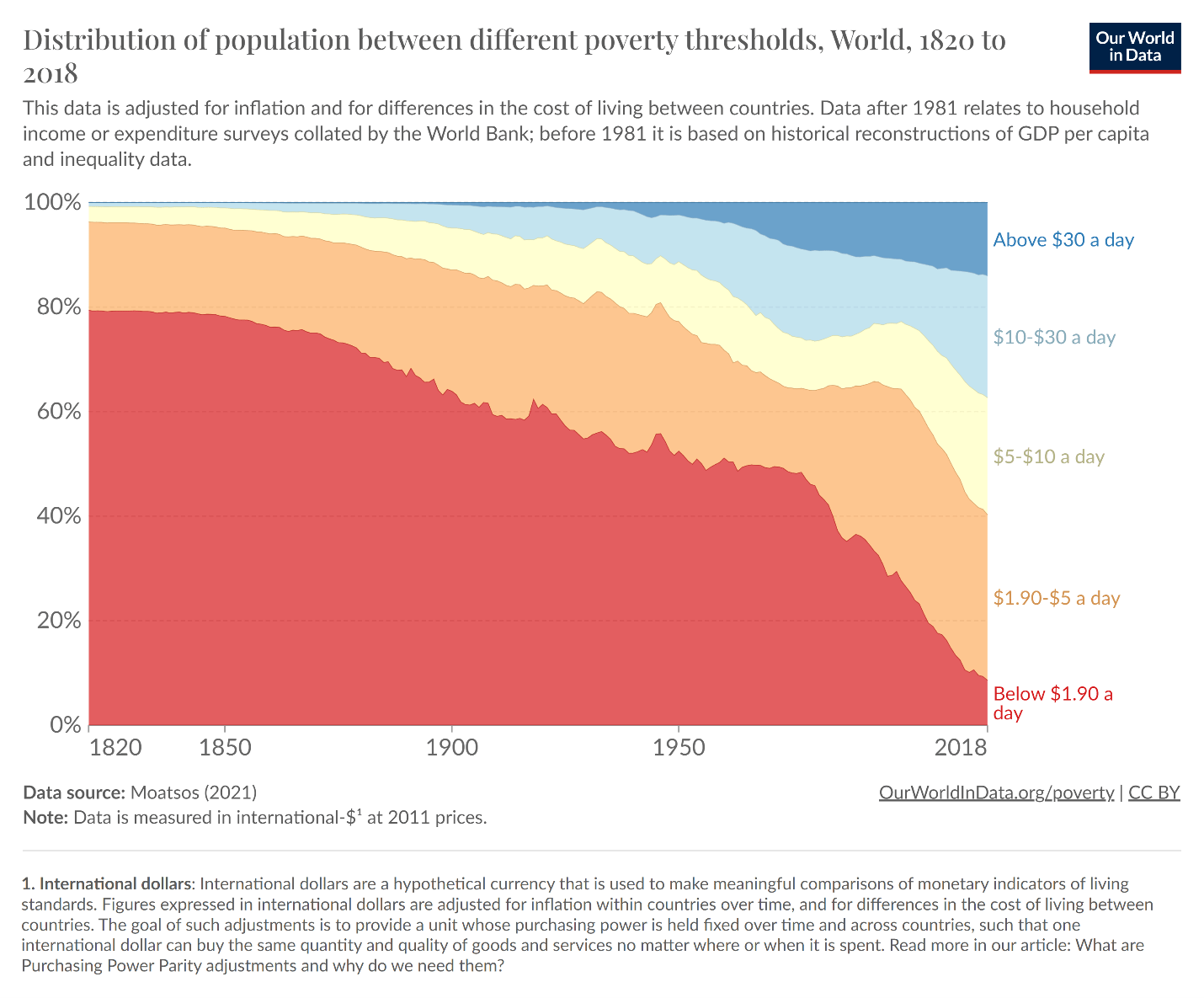

Contrary to the popular misconception that capitalism has made the rich richer and the poor poorer, this new wealth contributed to growing the economies of every world region while outpacing population growth. While the world’s extreme poor have become wealthier so too have all other economic classes.

Investment has to start somewhere. Growth is never equal and simultaneous across the world at once. But soon after it starts in one place, the nature of markets causes abundance to spread. When people get wealthier in one region, they can afford to purchase and invest more in other regions, which allows workers in those poorer regions to better monetize their labor. When wealthier regions can afford to invest in new and improved production methods, this allows more consumers in the global market to satisfy their wants and needs because it increases the supply and reduces the price of goods. Investment in new technology and innovation creates knowledge that can spread and be learned far and wide, and knowledge is a special resource because its abundance increases rather than decreasing when more people consume it. These are among the economic forces that have massively reduced global poverty since the Industrial Revolution.

What’s So Great about Growth?

A growing economy isn’t about stacks of paper money getting taller, or digits being added to the spreadsheets of bank ledgers. These things may be indicators of growth, but the growth itself is composed of goods and services becoming more abundant. Farms and factories producing more and better consumption goods; engineers creating better machines and materials; clean water reaching more communities; sick people receiving better healthcare; scientists running more experiments, poets writing more poems, education becoming more broadly accessible; and for whatever other forms of value people choose to exchange their savings and labor.

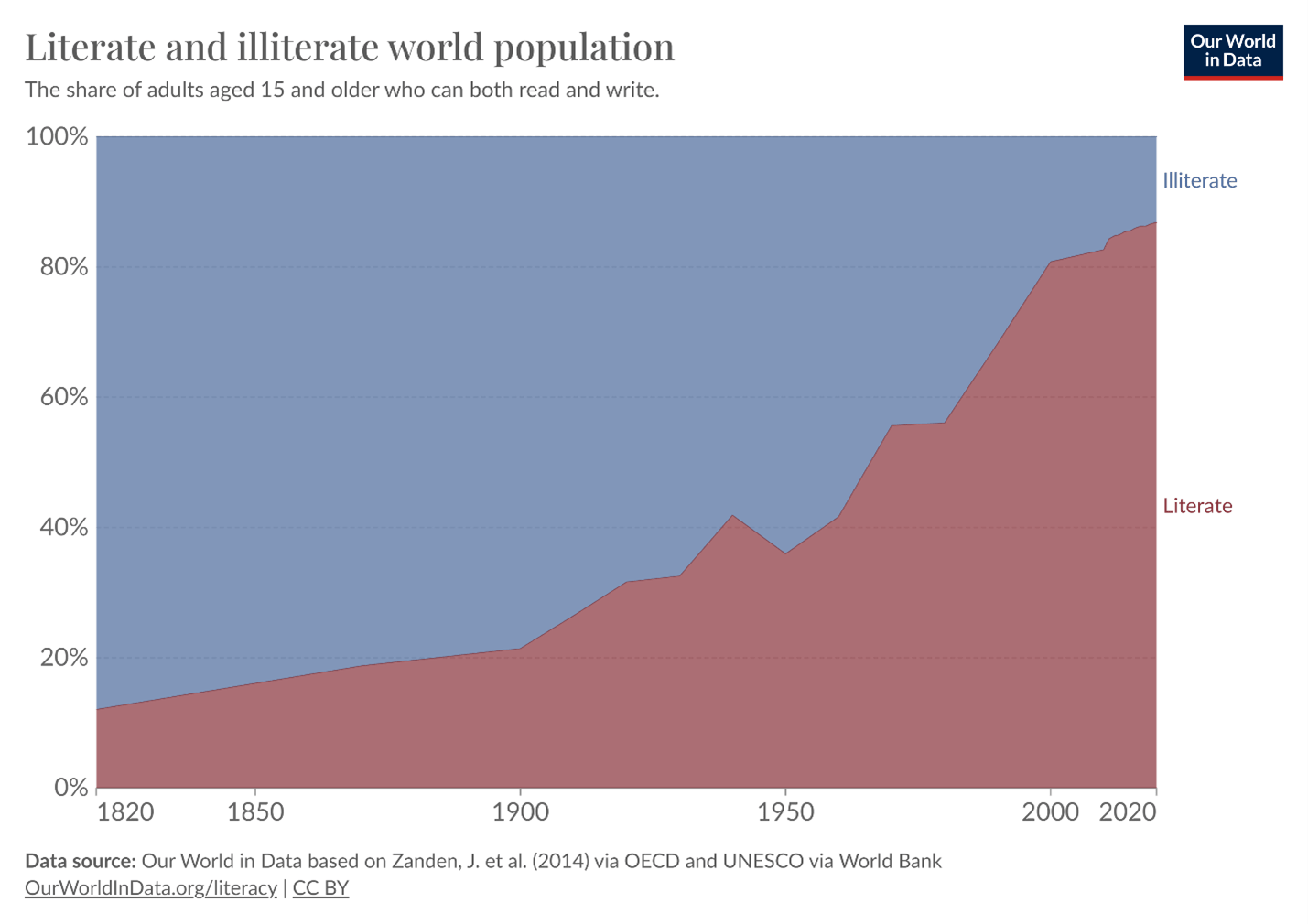

Gross domestic product or GDP (called gross world product or world GDP when applied at the global level) is an imperfect but useful and widely employed measure of economic growth, and its reflection in the real world takes such forms as rising life expectancy, nutrition, literacy, safety from natural disaster, and virtually every other measure of human flourishing. This is because, at the most fundamental level, “economic growth” means the transformation and rearrangement of the physical environment into more useful forms that people value more.

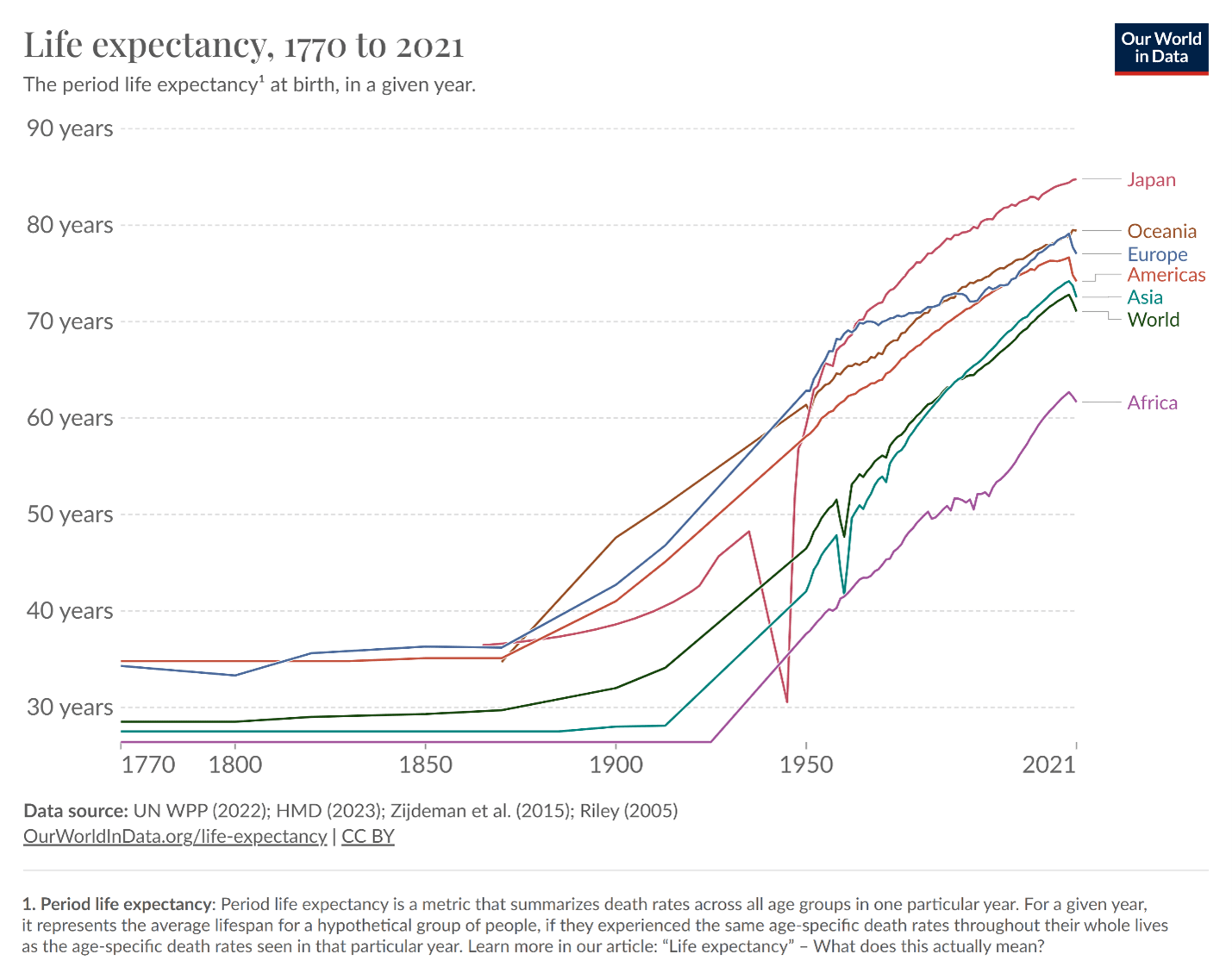

Before the year 1820, human life expectancy had always been approximately 30-35 years. But with the great decline in poverty and rise of capital investment in technology and medicine, global life expectancy has roughly doubled in every geographic region in the last century. Similar trends have occurred in global nourishment, infant survival, literacy, access to clean water, and countless other crucial indicators of wellbeing. While these trends are bound to take the occasional momentary downturn because of life’s uncertainties and hardships, the unidirectional accumulation of technological and scientific knowledge since the Age of Enlightenment gives the forward march of progress an asymmetric advantage. For example, the COVID-19 pandemic and lockdowns resulted in a brief and tragic decline in life expectancy, but the number has since risen to an all-time high of 73.36 years as of 2023.

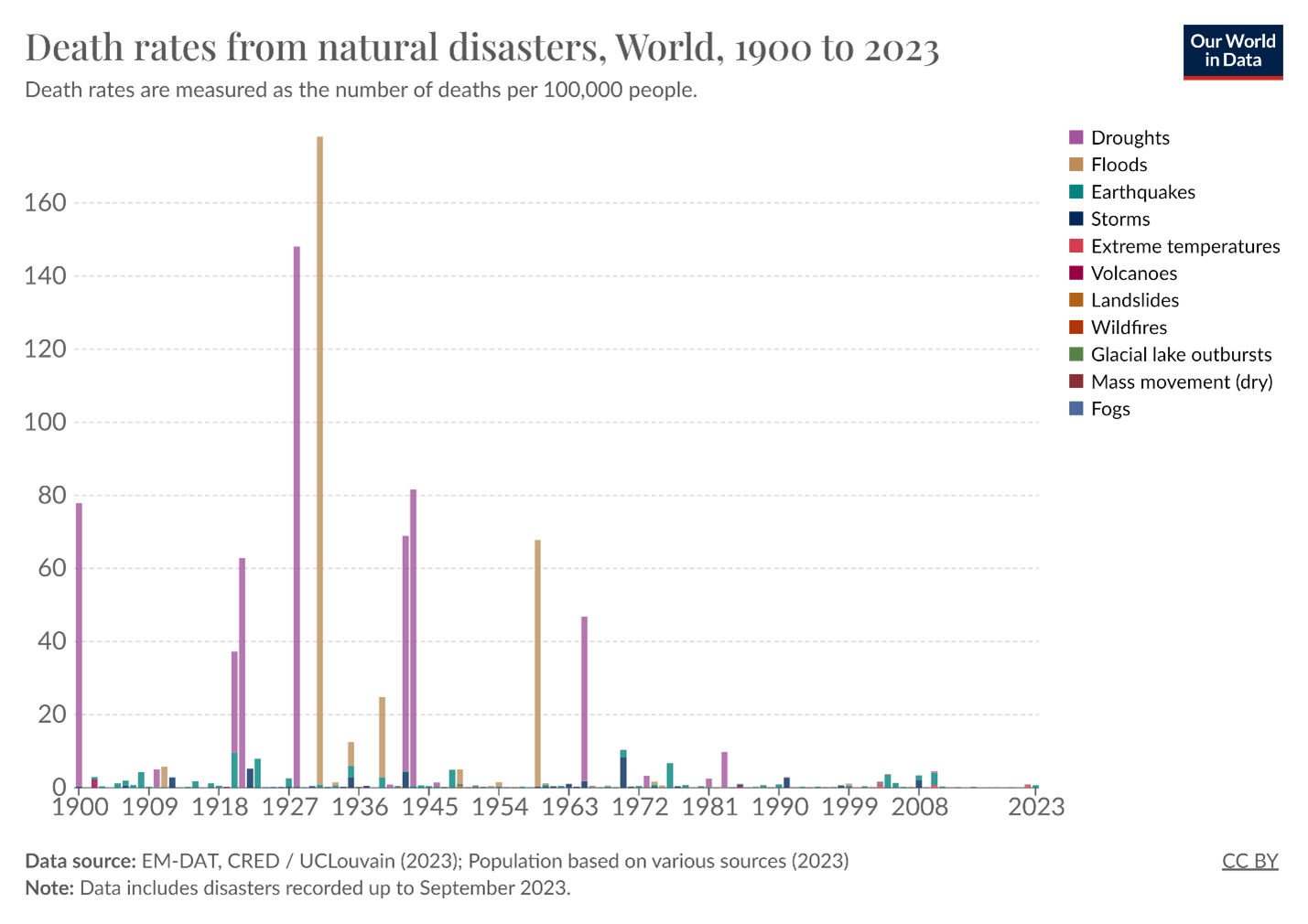

What is the direct causal connection between economic growth and these improvements to human wellbeing? Consider the example of deaths by natural disaster, which have fallen in the last century from about 26.5 per 100,000 people to 0.51 per 100,000 people. More wealth means buildings can be constructed from stronger materials and better climate controls. And when those protections aren’t enough, a wealthier community can afford better infrastructure such as roads and vehicles to efficiently get sick or injured people to the hospital. When those injured end up in the hospital, a wealthier society’s medical facilities will be equipped with more advanced equipment, cleaner sanitation, and better-trained doctors that will provide higher quality medical attention. These are just a few examples of how wealth allows humans to transform their world into a more hospitable place to live and face the inevitable challenges of life.

The benefits of economic growth go far beyond the maximization of health and safety for their own sake. If what you value in life is the contemplation of great art, the exaltation of your favorite deity, or time spent with your loved ones, wealth is what awards you the freedom to sustainably pursue those values rather tilling the fields for 16 hours per day and dying in your 30s. Wealth is what provides you access to an ever-improving share of the world’s culture by increasing the abundance and accessibility of printed, recorded, and digital materials. Wealth is what provides you with the leisure time and transportation technology to travel the world and experience distant wonders, remote holy sites, and people whose personal or professional significance to you would otherwise dwell beyond your reach.

As the Harvard University cognitive scientist Steven Pinker demonstrates in his popular book Enlightenment Now, “Though it’s easy to sneer at national income as a shallow and materialistic measure, it correlates with every indicator of human flourishing, as we will repeatedly see in the chapters to come.”

The Long-Term Future of Growth

Human psychology is ill-equipped to comprehend large numbers, especially as they relate to the profound numerical implications of exponentiation. If it sounds insignificant when politicians and journalists refer to a 1 percent or 2 percent increase or decrease in the annual growth rate, then like most people, you’re being deceived by a quirk of human intuition. While small changes to the economic growth rate may not have noticeable effects in the short term, their long- term implications are absolutely astonishing.

Economist Tyler Cowen has pointed out in a Foreign Affairs article, “In the medium to long term, even small changes in growth rates have significant consequences for living standards. An economy that grows at one percent doubles its average income approximately every 70 years, whereas an economy that grows at three percent doubles its average income about every 23 years—which, over time, makes a big difference in people’s lives.” In his book Stubborn Attachments, Cowen offers a thought experiment to illustrate the real-world implications of such “small changes” to the growth rate: “Redo U.S. history, but assume the country’s economy had grown one percentage point less each year between 1870 and 1990. In that scenario, the United States of 1990 would be no richer than the Mexico of 1990.”

Cowen gave the negative scenario in which the growth rate was 1 percent slower. US Citizens would have drastically shorter lifespans, less education, less healthcare, less safety from violence, more susceptibility to disease and natural disaster, fewer career choices, and so on. Now imagine the opposite scenario, in which US economic policy had just 1 additional percentage point of growth each year. The average American today would in all probability be living much longer, having much nicer housing, choosing from far more career opportunities, and enjoying more advanced technology.

Just imagine your income doubling, and what you could do for yourself, your family, or the charity of your choice with all that extra wealth. Something along those lines could have happened to most Americans. But instead, growth has been significantly slowed in the United States because taxes and regulations have constantly disincentivized and disallowed new innovations.

At the margins, many dying of preventable diseases could have been cured, many who spiraled into homelessness could have accessed the employment opportunities or mental health treatment they needed, and so on. While economic fortune seems like a luxury to those who already enjoy material comfort, there are always many at the margin for whom the health of the economy is the difference between life and death.

These are among the reasons that Harvard University economist Gregory Mankiw concludes in his commonly used college textbook Macroeconomics that, “Long-run economic growth is the single most important determinant of the economic well-being of a nation’s citizens. Everything else that macroeconomists study — unemployment, inflation, trade deficits, and so on — pales in comparison.”

When we think of the future our children or grandchildren will live in, depending on our choices between even slightly more or less restrictive economic policies today, we could be plausibly looking at a future of widespread and affordable space travel, life-changing education and remote work opportunities in the metaverse, new sustainable energy innovations, a biotechnological revolution in the human capacity for medical and psychological flourishing, genome projects and conservation investments to revive extinct and protect endangered species, and countless other improvements to the human condition. Or we could be looking at a drawn-out stagnation in poverty alleviation, technological advancement, and environmental progress. The difference may well hinge on what looks today like a tiny change in the rate of compounding growth.

At the broadest level, more wealth in the hands of the human species represents a greater capacity of humans to chart their course through life and into the future in accordance with their values. Like all profound and far-reaching forms of change, economic growth has a wide range of consequences, some intended and others unintended, many desirable and many others undesirable. But it is not a random process. It is directed by the choices of individuals, and allocated by their drive to devote more resources and more investment into those things they view as worthwhile. Ever since the Scientific Revolution, the Enlightenment, and the Industrial Revolution, the investment in human values has been on balance a positive sum game, in which one group’s gains do not have to come in the form of another group’s losses. This is demonstrated by the upward trends in human flourishing since the global rise in exponential economic growth. Indeed, it is intrinsic to the fundamental difference between a growing and a shrinking or stagnant economy: In a growing economy, everyone can win.